The gold bull run that ended in 2020 is nothing compared to today’s perfect storm.

Get ready for millions of investors flocking to gold as a safe haven…and for the price potentially soaring far higher than the records set over the last few months.

Gold Price – 10 Years

Record high of ~$2,190 per ounce on Mar. 19, 2024

Data Source: Trading Economics1

Gold Price – 6 Months

Record high of ~$2,190 per ounce on Mar. 19, 2024

Data Source: Trading Economics2

Smart investors aren’t surprised. The catalysts have been in the making for years.

There’s the short-term drivers:

High Inflation: Investors buy gold as a hedge against inflation. Meanwhile, price pressures are still elevated as US inflation ticked up again in February.3

Fed Rate Cuts: When interest rates drop, investors dump low-yielding assets for non-yielding gold.4

Source: Kitco5

Geopolitical Conflict: Escalating Middle East tensions. Russia’s war with Ukraine. The UN demanding a Gaza ceasefire. It all drives investors to gold as a safe haven.6

Then there’s the long-term drivers:

Central Bank Buying: The more gold they buy, the higher the price. Last year they bought just shy of 2022’s record.7

Inverted Yield Curve: When long-term interest rates are below short-term rates – like today – beware of recession…and watch gold, since it historically outperforms during recessions.8

Source: Forbes9

Source: Forbes9

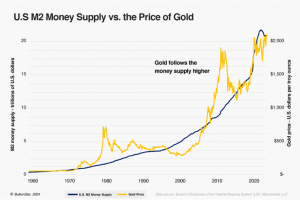

Debt & Money Printing: The more dollars printed, the less they’re worth…and the higher the price of gold since gold can’t be created willy nilly. That gives it intrinsic value.10

Source: Forbes11

Source: Forbes11

This has all happened before. History repeats itself. And each time, gold maintains its safe haven status as the ultimate hedge.

But gold hasn’t peaked yet. The recent highs are only up about 27% from the 2020 gold run. Past gold bull runs had much bigger price gains:12

-

-

- 1969-1980: 684%

- 1999-2011: 425%

- 2015-2020: 55%

-

So there’s still a lot of upside potential for gold.

That said, there’s far more potential for gold mining stocks. Investors are finding many gold stocks incredibly undervalued and massively oversold.

Source: Nick Laird, goldchartsrus.com, Reuters Eikon, Incrementum AG

Why? The AI stock bubble is grabbing all the attention right now.13

But remember, history repeats itself. So the AI bubble will fizzle. Today’s gold stock bargains will get market corrections.

And investors that got in early are likely to enjoy phenomenal gains.

Especially if they targeted the world’s hottest gold mining district: Canada’s Red Lake:

-

-

- 100 years of production

- Exceptionally high-grade gold14

- 30 million ounces produced15

-

Red Lake could potentially be home to the next Canadian gold rush.

Just ask Kinross Gold. In 2022, they paid US$1.1B for Great Bear Resources and its Great Bear Project in the Red Lake district.16 Since then, Kinross has grown the

project’s resource to 2.8 Moz at 2.7 g/t of measured and indicated resources and approximately 3.3 Moz at 4.5 g/t of inferred resources. 17

But Kinross is huge, expensive, and doesn’t have anywhere near the upside potential of a junior miner targeting near-term gold production in the region, like West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF).

In a Class of Their Own Among Junior Gold Miners

West Red Lake Gold Mines Ltd. (TSXV:WRLG) (OTCQB:WRLGF) only formed in late 2022 but has already been recognized by the TSX Venture Exchange as a 2024 Top 50 Company in the Mining category.18

West Red Lake Gold Mines is targeting near-term gold production with a targeted restart in 2025 at its Madsen Gold Mine in Canada’s Red Lake Gold District.

The mine is fully permitted, has historic production of 2.5 million ounces of gold,19 and represents a significant high-grade resource of 1.65 million ounces of gold at 7.4 g/t in 6.9 million tonnes (Indicated) and 366 Koz at 6.3 g/t Au (Inferred). 20

This company has heavyweight investors backing them, and legendary industry financier Frank Giustra, who sees big things to come for the gold market and particularly West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF), which he now owns an 11% stake in.21

West Red Lake Gold Mines’ (TSXV:WRLG) (OTCQB:WRLGF) leadership team is stacked with industry pros from billion-dollar gold producers, like Eldorado Gold, Coeur Mining, Detour Gold/Agnico Eagle Mines, Endeavour Mining, and Barrick Gold.

The company’s CEO, Shane Williams, was COO of Skeena Resources when it advanced the past producing Eskay Creek Gold project toward a restart. One of their Directors, Anthony Makuch, was CEO of Kirkland Lake Gold when it increased annual gold production by over 340% from 315 Koz to over 1.4 Moz.

West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF) also just closed a US$27.1 million upsized private placement.22

3 Catalysts for the Biggest Gold Bull Run Yet

Before we dive deeper into West Red Lake Gold Mines‘ (TSXV:WRLG) (OTCQB:WRLGF) story, it’s worth taking a closer look at how gold’s trajectory is providing an ideal backdrop for this upcoming producer.

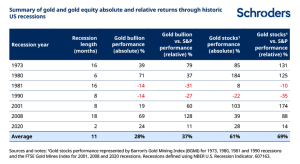

Catalyst #1: Recession

Going back to the 1950s, a better predictor than a recession is on its way is an inverted yield curve…which we have right now.23

Recessions are good news for gold prices (and gold miners). During the last seven US recessions, gold returns have tended to do well, but gold equities have done even better.

Source: Schroders24

Catalyst #2: Fed Rate Cuts

Lower interest rates make zero-yield gold appealing to investors.25 So it’s big news that the Fed is on track to lower interest rates 3 times in 2024 alone.26

Catalyst #3: Central Bank Buying

In 2023, central bank net purchases of gold hit 1,037 tons, just 45 tons short of the record set in 2022.27 And China’s central bank just added gold to its reserves for a 16th straight month in February.28

Put it all together and it creates the perfect gold market outlook for West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF) as the company marches toward near-term gold production with a targeted restart in 2025 at its Madsen Mine.

11 Criteria

for a Standout Gold Stock Opportunity

1

Strong Market: we’re seeing record-high gold prices with signs of major bull run

2

World-Class Location: High-Grade Red Lake Gold District with 30 Moz produced to date29

3

Top-Tier Assets: fully permitted Madsen Mine with past production of 2.5 Moz gold30

4

High-Grade Resource: 1.65 million ounces of gold at 7.4 g/t in 6.9 million tonnes (Indicated)31

5

Advanced Infrastructure in Place: including a brand-new 800 tpd mill

6

Near-Term Path to Production: With permits are in place, near-term production is targeted for 2025 at Madsen Mine

7

Upcoming Catalysts: mine restart plan will generate lots of news flow

8

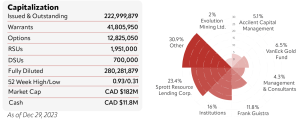

Backed by Prominent Investors: VanEck Gold Fund (6.5%), Sprott (23.4%), Frank Giustra (11.8%)

9

Robust Financial Foundation:$27.1M upsized private placement just closed32

10

Experienced Leadership: capital markets experts and industry pros from billion-dollar gold producers

11

Fully Permitted: All required permits are in place, setting up a quick return to activities.

Riding the Red Lake Gold Rush

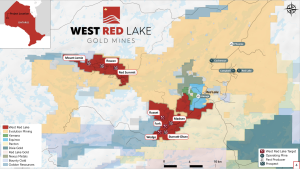

West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF) is located in one of the hottest gold mining regions in the world: the Red Lake Gold District.

So it’s no surprise they’re surrounded by high-grade discoveries, growing gold production, industry M&A activity, and billion-dollar gold producer neighbors that have seen major success in the district.

The Red Lake Gold District has produced 30 million ounces of gold to date from high-grade zones33 and hosts some of the world’s richest gold deposits.34 The area also has excellent access to infrastructure, including a highway, gas and power lines, and skilled workers.

In 2020, Newmont sold its Red Lake complex to Evolution Mining for $375 million cash.35 The asset’s Mineral Resource is 12.3 million ounces gold at 6.35 g/t in 60.4 million tonnes.36 Guidance for FY2024 is 125,000-135,000 ounces of gold for an increase of 3.4% to 11.7% YoY. 37

Evolution Mining also acquired Battle North Gold in 2021, a $343 million deal that involved several assets including the Bateman Gold Project, which contains a reserve of 3.563 million tonnes at 5.54 g/t gold, containing 635 Koz of gold.38

Press Releases

- West Red Lake Gold Mines Outlines 2024 Regional Exploration Strategy For Madsen And Rowan

- West Red Lake Gold Intersects 68.36 g/t Au over 1.1m and 13.83 g/t Au over 3.95m at South Austin Zone – Madsen Mine

- West Red Lake Gold Grants Equity Incentive Awards

- West Red Lake Gold Accelerates Definition Drill Program At North Austin

- West Red Lake Gold Closes Second Tranche Of Gold Linked Notes Offering

In 2022, Kinross paid ~US$1.1 billion to acquire Great Bear Resources and its Great Bear Project (just off the bottom of the map above).39 Since then, Kinross has added over 1 million ounces of higher-grade gold resource with the project now representing 2.8 Moz gold at 2.7 g/t measured and indicated and 3.3 million ounces gold at 4.5 g/t inferred.40

In 2023, Pan American Silver paid $4.8 billion for Yamana Gold41 with Yamana’s Canadian assets going to Agnico Eagle Mines, including the Red Lake project’s prospective land package that’s adjacent to West Red Lake Gold Mines‘ holdings around their Madsen Mine.42

The table below shows how West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF) shares the same region and has high-grade gold resources like these billion-dollar gold companies, but has incomparable upside potential.

Proven Ability to Identify & Capitalize on Value-Adding Opportunities

Acquiring the past-producing Madsen Mine was transformational for West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF).

Up to 1999, the Madsen Mine produced 2.5 million ounces of gold at an average grade of 9.7 g/t. In 2014, Pure Gold Mining Inc. bought the mine. Pure Gold defined high-grade resource zones, got the mine fully permitted and built the infrastructure. The company also poured first gold by the end of 2020 and started commercial production in August 2021.46

As the mine’s potential continued to unfold, Pure Gold was the darling of the market for a few years, hitting a $1.15-billion-dollar market cap in their heyday.

The problem was, Pure Gold prioritized a sale for the mine rather than its successful operation and its $1 billion valuation made the company an expensive takeover target. So, despite the asset’s tremendous value, the company ran out of money waiting for a buyer.

Then, Frank Giustra and his team put together a bid and West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF) strategically scooped up the asset in June 2023 for just C$6.5 million cash, 40.73 million WRLG shares, a 1.0% secured Net Smelter Royalty, and US$6.8M deferred consideration.47

Check out this video to learn why Jay Martin thinks West Red Lake Gold is the “deal of the decade.”

Advancing the Madsen Gold Mine Toward 2025 Restart

Since West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF) acquired the Madsen Mine, the company has been strategically moving it forward to a restart and a targeted gold production date of 2025.48

The nearly 80 km2 (31 sq mile) land package sits on highly prospective exploration targets, in a world class gold district, and contains what Mining.com’s staff has called one of the world’s highest-grade, undeveloped gold projects.49

The asset also includes significant and expandable surface and underground infrastructure, including:

-

-

- Brand new and expandable 800 tonne per day (tpd) processing mill

- Brand new double ramp access to underground

- 1,275-metre (4,183-foot) deep shaft

- Water treatment plant

- Excess tailings capacity

- Brand new and expandable 800 tonne per day (tpd) processing mill

-

Just one month after completing the acquisition of the Madsen Mine, West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF) confirmed the Mineral Resource Estimate for the asset through an independent report from SRK Consulting, which includes: 50

-

-

- 1.65 million ounces of gold at 7.4 g/t in 6.9 million tonnes (Indicated)

- 0.37 million ounces of gold at 6.3 g/t in 1.8 million tonnes (Inferred)

-

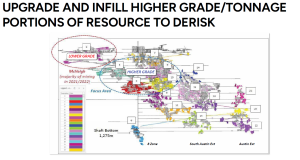

Since then, West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF) has continued to de-risk the asset’s resource by completing additional in-fill drilling focused on near term, high-grade zones.

West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF) is focused on an accelerated path to target gold production in 2025 that will generate a lot of significant catalysts and milestones to announce to the market. Here are just some of what the mine restart plan includes: 51

-

-

- Pre Feasibility Study (PFS) by Q4 2024

- 38,000-meter (124,672-foot) underground drill program by Q4 2024

- 3,200 meters (10,498 feet) of underground development by Q1 2025

- Targeting a Madsen Mine restart by Q3 2025

- Optimizing the project to focus on sustainable cash flowing operation

-

Money in the Bank & Skin in the Game

-

-

- Accilent Capital Management (5.1%)

- VanEck Gold Fund (6.5%)

- Sprott Resource Lending Corp. (23.4%)

- Legendary industry financier Frank Giustra (11.8%)

- Other institutional investors (16%)

-

Their management and consultants have 4.3% ownership, which shows they’re also convinced West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF) is a smart investment.

Leadership That’s Done This Before

West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF) has the advantage of leadership that’s learned from past successes how to march the company forward to success.

11 Reasons

Why West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF) Should Be On Your Radar

1

Strong Market: we’re seeing record-high gold prices with signs of major bull run

2

World-Class Location: high-grade Red Lake Gold District with 30 Moz produced to date52

3

Top-Tier Assets: fully permitted Madsen Mine with past production of 2.5 Moz gold53

4

High-Grade Resource: 1.65 million ounces of gold at 7.4 g/t within 6.9 million tonnes (Indicated)54

5

Advanced Infrastructure in Place: includes brand-new 800 tpd mill & water treatment facility

6

Near-Term Path to Production: targeting 2025 restart of Madsen Mine

7

Upcoming Catalysts: mine restart plan will generate lots of news flow

8

Backed by Prominent Investors: VanEck Gold Fund (6.5%), Sprott (23.4%), Frank Giustra (11.8%)

9

Robust Financial Foundation: $27.1M upsized private placement just closed55

10

Experienced Leadership: capital markets experts and industry pros from billion-dollar gold producers

The ultimate gold bull run has already started. That’s a major wind at the back of West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF) as they move their Madsen Mine toward its 2025 restart. The headlines from new gold price records and the company’s milestones should attract a lot of market attention.

If you’re interested in outstanding gold mining opportunities, keep a close eye on West Red Lake Gold Mines (TSXV:WRLG) (OTCQB:WRLGF) as it may start to run away.

Shane WilliamsB. Eng. M. Sc – CEO, President & Director

Shane WilliamsB. Eng. M. Sc – CEO, President & Director Frank GiustraAdvisor

Frank GiustraAdvisor Anthony MakuchB.Sc, P.Eng – Director

Anthony MakuchB.Sc, P.Eng – Director Duncan MiddlemissDirector

Duncan MiddlemissDirector Hugh AgroB.Sc., MBA, P.Eng. (Non-Practicing) – Director

Hugh AgroB.Sc., MBA, P.Eng. (Non-Practicing) – Director