Many investors enter the market dreaming of following Warren Buffett’s path to becoming a billionaire.

But here’s a stark reality—the system is rigged against that very dream.

“If they told everybody what a simple game it was, 90% of the income of the people that were speaking would disappear.” – Warren Buffett

But that hasn’t stopped anyone from trying to “beat the market.”

In 2011, retail investors accounted for just over 10% of total trading volume.1

Fast forward to 2023, and that number has more than doubled to 23%.2

This explosive growth might seem to signal a new era of prosperity for the everyday investor.

Yet, the reality is a sobering counter-narrative: over 70% of these investors lose money.3

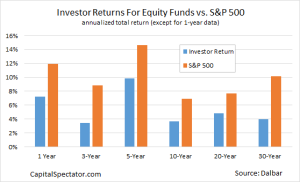

Over a 30-year period, the average equity investor earned just a hair below 4% a year4 —a figure that hovers just above historical inflation rates5 and pales in comparison to the S&P 500’s sturdy 10% average annual return over the last 90 years.6

Imagine this…

$10,000 invested and growing at 4% over 50 years balloons to about $71,000.

But that same $10,000, if invested in the S&P 500 at a 10% rate, would explode to an eye-watering $1.17 million.7

The difference isn’t just substantial; it’s life-changing.

But hey, even the pros find it hard to outperform the S&P 500.

Source: AEI.org8

Warren Buffett famously called their bluff when he bet a New York money management firm that the S&P 500 would outperform a portfolio of five hedge funds over 10 years.

The hedge funds averaged 36.3% net of fees. Buffett’s chosen S&P 500 index fund returned 125.8%.9

“When trillions of dollars are managed by Wall Streeters charging high fees, it will usually be the managers who reap outsized profits, not the clients.” – Warren Buffett10

This is the same snare that catches many retail investors, who are often persuaded by banks or advisors to sink their funds into mutual funds burdened with hefty management fees, devouring any potential for substantial returns.

Now, imagine a company that empowers and educates people to invest with Buffett’s wisdom. Consider the vast potential of such a market and the scalability of a business that taps into this need.

Enter Mogo Inc. (NASDAQ:MOGO) (TSX:MOGO), a fintech company with a vision of creating the next generation of millionaires.

Mogo Inc. (NASDAQ:MOGO) (TSX:MOGO) isn’t new to the game.

Not only is it one of Canada’s largest FinTech companies, with over 20 years of operating history, it’s one of the first FinTech’s globally.

Over the last 20 years, this company has grown to over 2 million members.11

After solidifying its spot in the financial services space, Mogo Inc. (NASDAQ:MOGO) (TSX:MOGO) made a series of strategic acquisitions and investments to diversify its offerings.

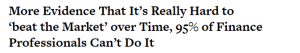

The company has 3 pillars:

-

- Wealth and short-term cash business: promotes smart investing and provides its members access to short term cash

- Payments business: low-cost next-gen payments platform across Europe and Canada

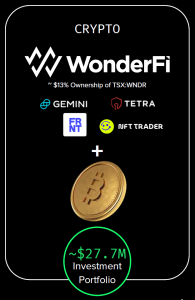

- Investment portfolio: with a big concentration in crypto-related ventures, including the largest stake in Canada’s leading crypto exchange, WonderFi (TSX:WNDR)

That means Mogo Inc. (NASDAQ:MOGO) (TSX:MOGO) shareholders have exposure to two of FinTech’s highest growth areas:

-

-

- Payments

- Wealth Management

-

Plus significant exposure to crypto-based ventures without the inherent risk (0% of Mogo’s revenue is crypto related, but about 35% of their total market cap value is in crypto-related business investments).

FinTech Leader with Profitable Multiple-Revenue-Stream Model

While Mogo Inc. (NASDAQ:MOGO) (TSX:MOGO) already has a 20-year track record of success, they now have a new wind at their backs.

The public’s trust in traditional banks is eroding while the preference for disruptive, low cost, and easy-to-use FinTech is growing.

In 1979, 60% of Americans had high confidence in banks. By 2006, that dropped to 41%. Then after the global financial crisis, it sank to 22% in 2009 before hitting an all-time low of 21% by 2012.12

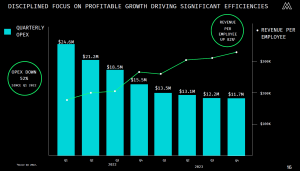

No surprise then that Mogo’s (NASDAQ:MOGO) (TSX:MOGO) most recent quarterly and fiscal year results (2023) were very impressive:

-

- Annual payments volume of $9.9B (up 36% YoY)

- Q4 adjusted EBITDA of $2.7 million at 16% margin (up 1006% YoY)

- Mogo members increased to 2.1 million (up 6% YoY)

- Assets under management increased to $351.3 million (up 23% YoY)

- $55.6 million of cash and investments at year end, including $27.7 million of crypto-related investments13

Instead, Mogo is repurchasing their shares.

They’ve repurchased 1,074,353 shares (4.4% of all outstanding common shares) since 2022. And in March 2024 they announced they intend to repurchase even more shares.

That’s the ultimate vote of confidence. But why are they doing it?

As management explained on March 21, 2024, they believe “the market price of its common shares does not accurately reflect their underlying value and the repurchasing for cancellation of such common shares is intended to enhance long-term shareholder value.”14

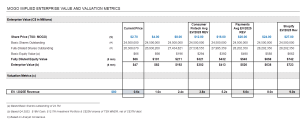

That belief is based on third-party data that show Mogo (NASDAQ:MOGO) (TSX:MOGO) is trading at a heavily discounted EV/Revenue Multiple of only 0.7x compared to an average of around 6.3x among the company’s competitors15 (we’ll dive into why that is in a moment).

That means Mogo’s (NASDAQ:MOGO) (TSX:MOGO) disruptive FinTech value proposition is in growing demand from its target market while the company’s shareholders are sitting on a stock with tremendous upside potential.

Wall Street Icon and CNBC Contributor Agrees – It’s Time to Rethink Trading Apps

MOGO’s President & Co Founder, Greg Feller, posted to X.com expressing that he feels the complexion and feature sets of popular investing apps do not promote long-term, thoughtful investing, and are rather driving meme-stock investing (while pointing out RoaringKitty’s return to social media causing GameStop to rally again).

Shortly after posting, Wall Street Icon and CNBC Contributor Thomas Lee of FSInsight.com retweeted Feller’s post. The Crypto world also showed support, with Bitwise’s CEO also liking the post. Perhaps the support Feller’s post received suggests that during the era of “Dumb Money”, it’s time for smarter investing apps, and maybe it’s the perfect time for #BuffetMode.

8 Reasons

Mogo Could be the Next Breakout FinTech Stock

1

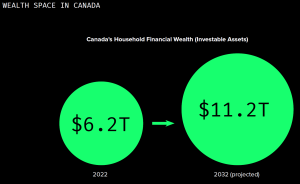

Multi-Trillion-Dollar Market: Canadian investable assets to hit $11.2T by 2032 at CAGR of 6.2%16

2

Growing Demand for FinTech: Declining trust in banks & rising preference for disruptive, low cost, easy-to-use alternatives

3

Mogo’s Multiple-Revenue-Stream Model: including two of FinTech’s highest growth areas – payments & wealth management

4

Significant Exposure to Crypto: ~35% of total market cap value in crypto-based ventures, including largest stake in Canada’s leading crypto exchange, WonderFi (TSX:WNDR)

5

Wealth-Building Value Proposition: educating & motivating people to invest and grow wealth like Warren Buffett

6

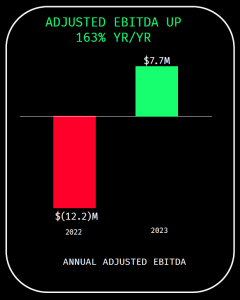

EBITDA Positive & Focus on Growth: adjusted EBITDA up 1006% YoY and positive YoY revenue growth in Q4 2023

7

Fully Aligned Management Team: ~15% insider ownership; co-founders never sold a share; aggressive ongoing share buyback program

8

Heavily Discounted Valuation: 0.7x EV/Revenue Multiple compared to 6.3x average among competitors

Helping the Next Generation of Canadians Become Millionaires

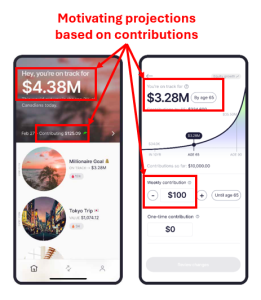

Mogo’s (NASDAQ:MOGO) (TSX:MOGO) cutting-edge wealth-building app, Moka.ai, gives Canadians a big advantage over what banks and the broken financial system of yesterday offer.

Canadians clearly have money to build wealth…

Source: ISS Market Intelligence forecast17

…but they start investing too late and they’re not using winning strategies.

Canadians believe they’ll need about $1.7 million to retire,18 but over 75% of those aged 55-64 that aren’t retired already have only $100,000 or less in savings.19

Moka provides a low-cost, set-it-and-forget-it passive investing solution powered by the S&P 500’s proven returns.

For only $7 a month, the Moka app gets subscribers excited about becoming a millionaire by automating monthly investments in an S&P 500 ETF to predictably grow wealth.

With Moka, instead of banks making money from high management fees, or trading platforms encouraging frequent trading that earns them more commissions, it’s the investor that’s winning.

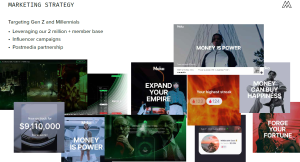

Mogo’s (NASDAQ:MOGO) (TSX:MOGO) marketing strategy targets Gen Z and Millennials for the app, but anybody can use Moka.

But Moka isn’t the only significant investment Mogo Inc. (NASDAQ:MOGO) (TSX:MOGO) has made in its wealth-building business. They also have their unique $8/month MogoTrade app.

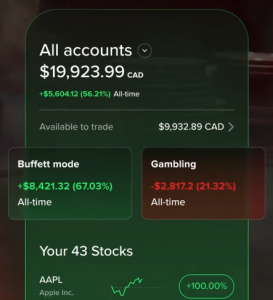

But far more important is the app’s in-your-face emphasis on actual investment results.

Mogotrade gives people the option to track their trades in either the “Buffett Mode” or the “Gambling Mode.”

Before buying a stock, they’re asked if they did their due diligence and other questions to determine if they’re basically gambling or investing like Buffett.

Then the app makes it abundantly clear how the “Gambling Mode” speculations are performing compared to their “Buffett Mode” portfolio.

It’s all about educating and motivating for real success.

It’s also easy to see how that would create a growing army of happy long-term subscribers with higher lifetime values than customers of Mogo’s competitors.

Press Releases

- Mogo To Participate In EF Hutton Annual Global Conference

- Mogo Extends Maturity Of $60 Million Credit Facility To 2026

- Mogo Reports Results For Q1 2024

- Mogo Reiterates Support For KAOS Capital’s Call For Change At WonderFi

- Mogo Nominates Independent Candidate For Election To WonderFi’s Board Of Directors – Supports KAOS Capital’s Call For A Fundamental Transformation Of Board

Undervalued Compared to Other Companies in the Space

To get a sense of how Mogo Inc. (NASDAQ:MOGO) (TSX:MOGO) stacks up against its competitors, we’ll look at Block, SoFi, Nu Holdings, and later, Wealthsimple.

Like Mogo:

-

- Block Inc. has multiple FinTech business pillars, including Square (payments), Cash App (investing), and others

- Sofi helps its members borrow, make payments, invest (through SoFi Invest), and more

- Nu Holdings offers low-cost FinTech services for borrowing, making payments and investing, specifically in Brazil, Mexico, and Colombia

But as mentioned earlier, Mogo (NASDAQ:MOGO) (TSX:MOGO) represents far greater upside potential due to currently trading at a heavily discounted EV/Revenue Multiple of only 0.7x compared to an average of around 6.3x among its competitors. 20

Wealthsimple, meanwhile, is a private Canadian company that, like Mogo’s Moka and MogoTrade apps, provides education and a platform for investment trading.

Since launching in 2014, Wealthsimple has gained 3 million clients, attracted $30 billion in assets, and earned a valuation of $2 billion from Bloomberg.22 In 2021 Wealthsimple also raised money at a $5 billion valuation.23

| Accounts Offered | Exchanges | Commissions | Pricing | |

|---|---|---|---|---|

| Wealthsimple | Tax-free savings accounts (TFSAs); Registered retirement savings plans (RRSPs); Non-registered personal accounts | Canadian & US exchanges | None | Management fees starting at 0.5% on managed investment accounts |

| Mogo | Tax-free savings accounts (TFSAs); Registered retirement savings plans (RRSPs); Non-registered personal accounts | Canadian & US exchanges | None | Flat monthly subscription rates ($9/mo MogoTrade; $7/mo Moka.ai) |

While Wealthsimple’s managed account fees are lower than the big banks, it’s increasingly looking like those banks by trying to put people in products with higher fees while encouraging more frequent trading.

In contrast, Mogo’s (NASDAQ:MOGO) (TSX:MOGO) model is aligned with the goals of its customers: flat subscription fees, low-frequency trading, and targeting long-term success.

Again, it’s easy to see how that would create longer-term subscribers and higher lifetime customer value.

Strong Fundamentals, So Why Undervalued?

Everything about Mogo Inc. (NASDAQ:MOGO) (TSX:MOGO) sounds great so far…so why is it so significantly undervalued?

Because the market has an overbalanced focus on one business fundamental: revenue growth.

The market has also been ignoring small cap FinTechs since valuations fell off end of 2021 but this has recently started to change as demonstrated by the $500 million market cap of US-based fintech Dave Inc (NASDAQ: DAVE).

After hitting a high of $491 in February 2022 fell 99% to a low of $4.50 in May 2023. However the market has recently rediscovered DAVE as the stock is up almost 900% in the last 11 months.

We all know how even short-term drops in revenue can pummel a stock, even if the drop occurred because the company is focused on long-term strength.

That’s what happened to Mogo:

-

-

- Interest rates started climbing in late 2021

- Raising capital got harder

- So Mogo cut their operating expenses (OPEX) by 52% over the next several quarters

-

If that sounds like good business management, that’s because it is.

However, those OPEX cuts mainly came from exiting a handful of subscale or unprofitable services and products…that’s what it took to get lean and mean in the new economy.

Since then, Mogo Inc. (NASDAQ:MOGO) (TSX:MOGO) has had seven quarters in a row of increasing EBITDA.

Being cash flow positive is another strong business fundamental. But by exiting those products in 2022, Mogo had lower YoY revenue in 2023.

Yes, they’ve grown their revenue sequentially every quarter since then…

…but the market’s over emphasis on revenue growth YoY punished Mogo’s (NASDAQ:MOGO) (TSX:MOGO) stock and left them undervalued.

The good news for Mogo shareholders is that the company’s most recent financials showed Q4 2023 to be their first positive quarterly revenue growth YoY since Q4 2022.

So watch for Mogo Inc. (NASDAQ:MOGO) (TSX:MOGO) to get back into growth mode in 2024 and potentially go from undervalued to overperforming.

Significant Investment in Crypto Businesses

The global crypto market was valued at US$4.67B in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 12.5% from 2023 to 2030, reaching $11.71B USD.24

Mogo Inc.’s (NASDAQ:MOGO) (TSX:MOGO) $27.7 million of crypto-related investments25 positions the company to benefit from that ongoing crypto sector growth.

While 0% of Mogo’s revenue is crypto related, about ~35% of their total market cap value is in crypto-related ventures, including:

-

-

- Gemini Trust – an American crypto exchange and custodian bank founded by the Winklevoss brothers

- Tetra Trust – Canada’s first licensed digital asset custodian

- NFT Trader – a Canada-based advanced NFT trading platform

-

Then there’s WonderFi, the holding company for Bitbuy and Coinsquare, two of Canada’s largest crypto trading platforms, and SmartPay, a crypto payments processing platform. WonderFi has combined assets under custody exceeding $1 billion.26

Mogo (NASDAQ:MOGO) (TSX:MOGO) is WonderFi’s largest shareholder, with ~87 million shares for ~13% ownership, valued at $25.7 million as of December 31, 2023.27

On top of all that, Mogo has been putting some BTC and BTC ETFs on its balance sheet.

Tight Cap Structure & Strong Balance Sheet

Mogo Inc. (NASDAQ:MOGO) (TSX:MOGO) has done an excellent job here.

In 2023, they did a 3/1 reverse stock split. Over the last 2 years they bought back 4.4% of their outstanding shares. Now they have only a very low 24.5M shares outstanding.

They also have a very tight float, with ~15% held by insiders and ~10% held by longtime shareholder BLOK ETF.

Plus, they ended 2023 with a balance sheet that included $55.6 million of cash and total investments.28

Experienced & Proven Team

Mogo Inc. (NASDAQ:MOGO) (TSX:MOGO) couldn’t have built their 20-year success story without an exceptional team of business founders and builders. The company was founded by identical twin brothers, David and Gregory Feller. Greg has a blue chip finance pedigree, after graduating with his Beta Gamma Sigma with an MBA from Kellogg at Northwestern University, he spent 16 years on Wall street including working at Goldman Sachs in silicon valley during the .com days and most recently working with one of the greatest investors in the world, Ken Griffin at Citadel.

8 Reasons

Mogo Could be the Next Breakout FinTech Stock

1

Multi-Trillion-Dollar Market: Canadian investable assets to hit $11.2T by 203231

2

Growing Demand for FinTech: Declining trust in banks & rising preference for disruptive, low cost, easy-to-use alternatives

3

Mogo’s Multiple-Revenue-Stream Model: including 2 of FinTech’s highest growth areas – payments & wealth

4

Significant Exposure to Crypto: ~35% of total market cap value in crypto-based ventures, including largest stake in Canada’s leading crypto exchange, WonderFi (TSX:WNDR)

5

Wealth-Building Value Proposition: educating & motivating people to invest and grow wealth like Warren Buffett

6

EBITDA Positive & Focus on Growth: adjusted EBITDA up 1006% YoY and positive YoY revenue growth in Q4 2023

7

Fully Aligned Management Team: ~15% insider ownership; co-founders never sold a share; aggressive ongoing share buyback program

8

Heavily Discounted Valuation: 0.7x EV/Revenue Multiple compared to 6.3x average among competitors

Everything points to 2024 being a landmark year for Mogo Inc. (NASDAQ:MOGO) (TSX:MOGO) as they work on turning their Q4 2023 revenue growth into an ongoing trend.

Click here to sign up for the company’s newsletter to stay current on Mogo Inc.’s (NASDAQ:MOGO) (TSX:MOGO) latest news and results.