When billionaire Gina Rinehart1 makes a big investment, it’s time to pay attention.

After all, the mining magnate owes her staggering $27.8 billion fortune to making smart bets.2

It may have been her father Lang Hancock who turned Western Australia into a mining powerhouse seven decades ago…

But it was Rinehart’s investment prowess that made her the richest person in Australia.

Now, she’s set her sights on building a lithium empire amid the electric vehicle (EV) boom alongside billionaire business partner Chris Ellison.

Their recent bold move? A monster $1.14 billion takeover of Azure Minerals with lithium giant SQM, a daring play in Western Australia’s lithium scene with no guaranteed returns.3

And they’re not alone. Tech titans Jeff Bezos and Bill Gates are also on board the lithium bandwagon, backing a Silicon Valley startup using AI to find lithium globally.4

Even investment legend Warren Buffett is getting in on the lithium rush, becoming one of the prospectors in California’s Lithium Valley with an eye on the Salton Sea’s $540 billion lithium deposit.5,6

Why? Because these visionaries know something crucial: the lithium-driven EV megatrend isn’t just a phase – it’s the future.

In 2023, EV sales soared to a stunning 14 million units sold – a 35% increase from 2022.7

But what many people don’t realize is that, without lithium, the EV revolution would come to a screeching halt.

No lithium = No batteries = No EVs

More lithium is essential to our green future and with very few domestic supply prospects, new discoveries play an absolutely vital role.

That’s what makes Li-FT Power Ltd. (TSXV:LIFT) (OTCQX:LIFFF) such a compelling player in the global lithium supply race.

Nestled in the vast wilderness of Northern Canada, Li-FT Power’s flagship lithium deposit is so enormous it’s visible from satellite imagery (no, really).

Poised to potentially become North America’s largest hard-rock lithium source, this under-the-radar company is poised to unlock the true power of Canadian lithium.

The Truth About Our Electrified Future

The EV race is heating up. Fast.

Both Canada and the US have bumped up their zero-emissions vehicle goals.

In Canada, new regulations mandate that by 2035, every new car sold must be emission-free. 8

Across the border, the US is echoing this same commitment. Under President Joe Biden, the nation has seen a significant uptick in EV adoption, with sales tripling and model availability doubling.

Earlier this year, Biden’s administration announced plans for 50% of vehicles on American roads to be EVs by 2030.

Then in December, Biden upped the ante, aiming to completely end gas-powered car sales by 2035.9

That leaves automakers just 12 years to completely phase out combustion engine cars, trucks, and SUVs.

It’s a monumental task indeed, requiring a LOT of new materials that haven’t been mined yet.

And the lithium industry will need to invest more than $116 billion just to meet these targets.10

But with only one producing lithium mine in North America, these bold ambitions could prove to be pipe dreams.

This is why lithium exploration companies like Li-FT Power (TSXV:LIFT) (OTCQX:LIFFF) are an essential ingredient in the EV race.

Li-FT Power owns what could be one of North America’s largest hard-rock lithium deposits.

We’re talking about a potential world-class hard-rock lithium portfolio that is so big it can be seen from satellite imagery.

But that’s not the only reason this company stands out from the masses.

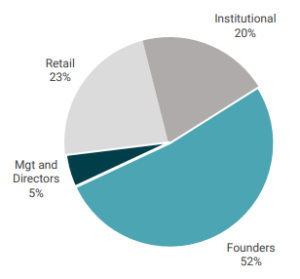

Li-FT Power (TSXV:LIFT) (OTCQX:LIFFF) boasts one of the tightest share structures we’ve ever seen with an incredible 52% owned by company founders, another 20% owned by institutions11 and just 41.6 million shares outstanding.

Additionally, management holds 5%, indicating a deep-rooted belief in the company’s direction and prospects.

This company is also well-financed, with $18 million in the bank to fund its aggressive drilling plans.

Li-FT Power (TSXV:LIFT) (OTCQX:LIFFF) has already completed 34,000 meters of drilling and the results thus far have been outstanding.

Li-FT Power not only has one of the most exciting hard-rock lithium exploration portfolios in the world, but this company has the drive and the backing to turn this epic deposit into one of North America’s most exciting discoveries.

7 Reasons

Li-FT Power (TSXV:LIFT) (OTCQX:LIFFF) Could Be North America’s Next Lithium Powerhouse

1

Unwavering Appetite for Battery Grade Lithium: The surging EV market desperately needs more lithium to meet ever-rising demand. The global EV market, which hit an impressive $561 billion in 2023, is projected to reach $906.7bn by 2028.12

2

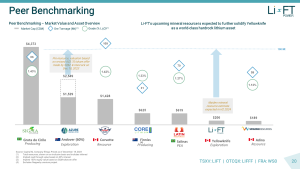

Huge Resource Potential: Li-FT Power’s (TSXV:LIFT) (OTCQX:LIFFF) Yellowknife Lithium Project has the potential to be one of North America’s largest hard-rock lithium deposits.

3

Infrastructure Advantage: Infrastructure is key for hard rock lithium deposits and Li-FT Power’s Yellowknife project is one of the best located relative to infrastructure with access to paved roads, a railway and the possibility to use a barge on Great Slave Lake.

4

Strong Shareholder Support and Tight Structure: With over 50% of shares being tightly held by founders and another 20% by institutions, Li-FT has a rock-solid support system with only 41.6 million fully diluted shares outstanding, and $18 million in cash on hand.

5

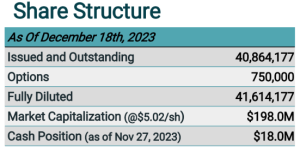

Expedited Aggressive Strategy: Li-FT Power (TSXV:LIFT) (OTCQX:LIFFF) has an expedited strategy for its Yellowknife Lithium project including an aggressive drill plan of over 60,000 meters (m) by Q2 2024 and is on track to complete an initial Mineral Resource Estimate by Q3 2024 and a PEA to follow shortly after

6

ESG-Friendly Operations: Li-FT has already established strong, collaborative relationships with local Indigenous communities and is located in a stable regulatory jurisdiction. The company has also been working towards its Environmental Assessment since the project began, with initiation set for 2025

7

Solid Team With Some Serious Mining Cred: Li-FT Power (TSXV:LIFT) (OTCQX:LIFFF) boasts an impressive roster of leadership including CEO and director, Francis MacDonald, co-founder of Kenorland Minerals and former exploration geologist at Newmont; Senior VP of Geology David Smithson, co-founder of Tier One Silver and former gold specialist for Newmont and Director Iain Scarr, a former Commercial Director and VP Exploration that brought three lithium projects in Argentina to feasibility study stage before being acquired.

One of the World’s Most Exciting Exploration Portfolios of Hard Rock Lithium Projects

Li-FT Power’s (TSXV:LIFT) (OTCQX:LIFFF) Yellowknife Lithium Project has emerged as one of the world’s most promising hard rock lithium exploration ventures.

As we mentioned, this project’s scale is immense, so large, that it’s visible from the sky.

But it’s not just its size that’s impressive – the amount of lithium that’s located on the surface can’t be ignored. As you can see from the image below, you can literally walk on the deposit.

When it comes to mining, infrastructure is key, especially with hard rock lithium.

Proper infrastructure allows the company to move these massive rocks from point A to point B to test and then extract the lithium from the rock.

Li-FT Power’s (TSXV:LIFT) (OTCQX:LIFFF) Yellowknife Lithium Project is in an absolutely prime location near crucial infrastructure, including the CN Railroad, a government-maintained highway (Highway and the Ingraham Trail), and Great Slave Lake.

Clearly you can see how wide and large these lithium deposits are. Now it’s just a matter of how deep they go.

Li-FT Power (TSXV:LIFT) (OTCQX:LIFFF) has wasted no time in moving this project forward, already completing a 34,000-meter drill program across eight pegmatites.

Li-FT Power’s latest drill results from the Yellowknife Lithium Project are a game-changer, uncovering impressive lithium concentrations.

Key highlights include a staggering 79 meters intersection at 1.13% lithium oxide (Li2O)13 and an even richer 26 meters at 1.56% Li2O,14 signifying a potentially vast and high-grade lithium resource.

Here is a breakdown of the best results so far at Li-FT Power‘s (TSXV:LIFT) (OTCQX:LIFFF) Yellowknife Lithium Project:

- Fi Southwest: Intersection of 79 meters at 1.13% Li2O

- Shorty Pegmatites: 25m at 1.13% Li2O

- Ki Pegmatite: 21 meters at 1.12% Li2O, including a higher-grade segment of 11 meters at 1.70% Li2O15

- BIG East Pegmatite: 26 m at 1.56% Li2O,

- Fi Main Pegmatite: 26 meters at 1.22% Li2O

- Nite Pegmatite: 12 meters at 1.51% Li2O

- Echo Pegmatite: Intersection of 13 meters at 1.48% Li2O16

These high-grade results not only showcase the richness of the Yellowknife Project but also position Li-FT Power (TSXV:LIFT) (OTCQX:LIFFF) as a leading player in Canada.

And that is just the beginning.

Press Releases

- LIFT Intersects 11 m at 1.52% Li₂O at its Nite pegmatite, Yellowknife Lithium Project, NWT

- LIFT Intersects 27 M At 1.26% Li2O And 22 M At 1.53% Li2O At Its Fi Main Pegmatite, Yellowknife Lithium Project, NWT

- LIFT Announces Changes To Its Board Of Directors

- LIFT Intersects 26 M At 1.56% Li2O At Its BIG East Pegmatite, Yellowknife Lithium Project, NWT

- LIFT Intersects 28 M At 0.99% Li2O At Its BIG East Pegmatite, Yellowknife Lithium Project, NWT

This company is on the fast track to discovery with an aggressive 60,000 meter drill program, which is expected to be completed by the end of Q2 2024.

Once drilling is complete this year, Li-FT Power (TSXV:LIFT) (OTCQX:LIFFF) plans to complete an initial Mineral Resource Estimate for the Yellowknife Lithium Project by Q3 2024 and advance it to a Preliminary Economic Assessment (PEA) stage within the next 18 months.

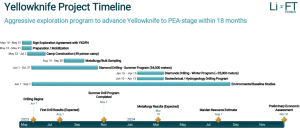

Sleeping Giant Poised to Challenge Emerging Leaders with Yellowknife Project

We can assume that Li-FT Power (TSXV:LIFT) (OTCQX:LIFFF) will most likely be releasing several press releases announcing their drill results and then move swiftly towards its PEA.

Just look at the successful exit of Azure Minerals and its significant $1 billion deal17 with Rinehart and SQM for its pre-resource Andover lithium project in Australia.

The deal’s monumental size highlights the high market value for these types of promising hard rock lithium projects that are in the same league as Li-FT’s Yellowknife asset. This recent Azure valuation reflects what the market is willing to pay for substantial lithium reserves, even before resource estimates are finalized.

Another prime example up north in Canada is Patriot Battery Metals. Earlier this year Patriot reported a resource of 109.2 Mt at 1.4% Li2O at its Corvette Property in James Bay in Quebec.18

One day after releasing the estimate, Albemarle, the world’s largest lithium producer, bought into Patriot, paying $82 million for a 4.9% stake in the company.19

Like Azure, Patriot’s resource estimates are not finalized, yet the company commands a market valuation of approximately $1.2 billion. This emphasizes the market’s recognition of lithium’s critical role in the growing EV sector and the premium it places on substantial, high-grade lithium resources.

It also highlights Li-FT Power’s (TSXV:LIFT) (OTCQX:LIFFF) potential value if it achieves a similar resource, which according to the company, is highly likely based on the results already reported.

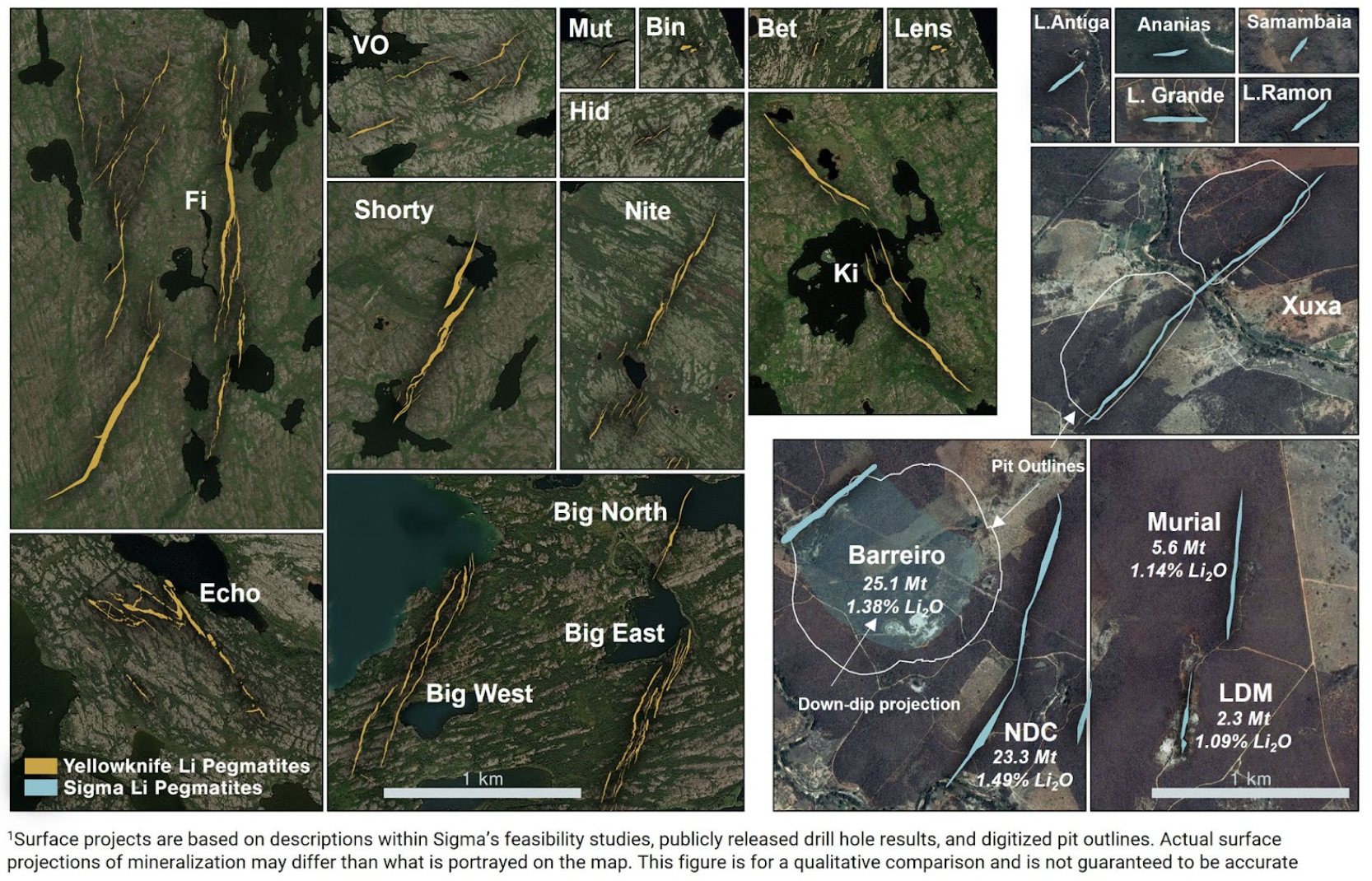

Another compelling comparison is Sigma Lithium’s Grota Do Cirilo Project, which offers a glimpse into what could be in store for Li-FT Power’s Yellowknife Lithium Project due to the geological similarities.

Sigma’s Grota Do Cirilo project may already be in production, but if Li-FT Power can confirm that the Yellowknife Lithium Project’s vast surface area does, in fact, contain as much lithium as they think it does in its upcoming MRE later this year, the project would eclipse Sigma’s.

Just take a look at the image below, which compares Li-FT Power’s Yellowknife Project (in yellow) to Sigma’s Grota do Ciriolo Project (in green).The colored polygons are the surface expressions of the lithium deposits, both at the same scale. It is easy to see that the Yellowknife Project has the potential host a significantly larger resource than Sigma’s project.

This positions Yellowknife not just as a promising endeavor but as a potential leader in lithium production. Li-FT Power, mirroring Sigma’s path from exploration to production, could soon leapfrog into a dominant position, offering an exceptional opportunity for growth in the lithium market.

Looking ahead, it’s worth noting that Li-FT Power’s aggressive exploration program, aiming to advance the Yellowknife project to PEA-stage swiftly, mirrors these industry successes.

The company’s upcoming mineral resource estimate is also anticipated to solidify Yellowknife’s status as a world-class hard rock lithium asset.

It’s reasonable to expect that these developments should elevate Li-FT Power to a competitive position among these established players, highlighting the untapped potential of Northern Canada’s lithium market.

Endless Pipeline of World-Class Lithium Potential

While the Yellowknife project is Li-FT Power’s (TSXV:LIFT) (OTCQX:LIFFF) primary focus for obvious reasons, the company is also exploring two other significant locations with immense lithium potential.

In the James Bay region of Quebec (also home to Patriot Battery Metals’ previously mentioned Corvette Property), Li-FT holds an extensive 2,300 km² area around the Whabouchi Li deposit. Recognized as one of North America and Europe’s largest high-purity lithium deposits, this area represents a substantial opportunity.

Li-FT’s (TSXV:LIFT) (OTCQX:LIFFF) strategic approach includes systematic geochemistry sampling, aiming to uncover pegmatites buried beneath glacial sediments. The completed diamond drilling in Q3 2023, followed by additional exploration in 2024, signifies an active exploration phase.

Further, the Cali property in the Northwest Territories is emerging as a significant site. Characterized by numerous spodumene pegmatites that outcrops over 500m of strike, it boasts a dyke swarm encompassing 5-10 individual dykes spread over a width of 120m. The presence of a high-grade spodumene boulder field at the surface adds to its allure.

With the land use permit secured and the surface program completed, Li-FT is gearing up for its first drilling program in the summer of 2024, aiming to unlock the potential of this promising site.

These two projects, alongside the flagship Yellowknife project, place Li-FT Power (TSXV:LIFT) (OTCQX:LIFFF) in a strong position to tap into the rapidly growing lithium market, with a diverse portfolio of high-potential lithium projects.

Li-FT Power’s strategic expansion into these areas underscores its commitment to developing a robust pipeline of world-class lithium resources.

A Leadership Team With a Track Record of Wins

When it comes to mining, the project is only as successful as the team behind. Fortunately, Li-FT Power (TSXV:LIFT) (OTCQX:LIFFF) has a leadership roster with some heavy hitters that have headed several major discoveries.

RECAP: 7 Reasons

To Put Li-FT Power (TSXV:LIFT) (OTCQX:LIFFF) On Your Watchlist

1

Growing Demand: The booming EV market, expected to reach $906.7bn by 2028, drives the need for more lithium.

2

Significant Resource: Yellowknife Lithium Project could be one of the largest hard-rock lithium deposits in North America.

3

Ideal Infrastructure: Yellowknife’s location offers advantageous access to transportation networks.

4

Strong Ownership: Over 50% of shares are held by founders, with 20% institutional ownership, 5% by management and $18 million in cash.

5

Fast-Track Strategy: An aggressive drill plan and upcoming Mineral Resource Estimate and PEA by 2024.

6

Community and Environmental Commitment: Collaborations with local Indigenous communities and ongoing Environmental Assessment.

7

Experienced Leadership: A team with notable mining expertise and successful project histories.

Li-FT Power (TSXV:LIFT) (OTCQX:LIFFF) is emerging as a key player in the lithium market, primarily through its expansive Yellowknife Lithium Project in Northern Canada.

Uniquely positioned to be one of North America’s largest hard-rock lithium deposits, Li-FT is redefining lithium hard-rock exploration with a strategic focus and robust shareholder support.

As they advance towards major milestones, including aggressive drilling plans and environmental assessments, Li-FT is a company that everyone is starting to pay close attention to.

Get more detailed information and learn more about their innovative projects and their vision for lithium’s future at their official website.

Francis MacDonaldCEO & Director

Francis MacDonaldCEO & Director Iain ScarrDirector

Iain ScarrDirector David SmithsonSenior Vice President, Geology

David SmithsonSenior Vice President, Geology