It’s time to watch copper again…

Renewable energy and electric vehicles (EVs) are sending copper demand skyrocketing.

Many investors don’t realize this, but copper, not lithium, is the most widely used metal in electric vehicles (EVs) as its use is extensive throughout the electrical components of the vehicle, not only the batteries.

And its job just became even more crucial.

Over 60 countries across the world have pledged to triple their renewable energy capacity and double energy efficiency by 2030.1

To do this, they’re going to need a gigantic supply of copper – an additional 4.2 million tons by 2030 to be exact.2

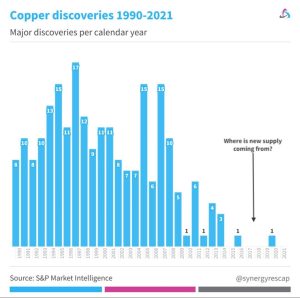

But here’s the twist: as demand soars, supply is faltering.

Major copper mines are facing disruptions, and years of underinvestment in exploration are catching up with us.4,5

Robert Friedland, the renowned copper investor and creator of Ivanhoe Mines, has been sharing updates on X, expressing that the copper market’s prospects are brightening more quickly than anticipated.

Financial Times reports ‘Traders bet on supply squeeze pushing up #copper prices’

“Elevated mine supply disruptions point to a deficit of 700,000 tonnes, and should start to feed through to refined production too,” said Morgan Stanley in a note, predicting a $10,200 per tonne… pic.twitter.com/ZFzUk26jKs

— Robert Friedland (@robert_ivanhoe) April 1, 2024

Jefferies updates on #copper: The fundamental outlook for #copper is improving faster than we had previously anticipated. Based on our supply and demand forecasts, the #copper market is entering an extended period of deficits now. We expect this to lead to declining inventories…

— Robert Friedland (@robert_ivanhoe) March 22, 2024

This supply-demand mismatch is setting the stage for a copper price surge.

We’re talking about a potential 75% increase in prices over the next two years. 6

It already hit a new 52-week highs above $9,000 per ton7—which is a more than 50% increase over its sub-$6,000 per ton pricing just five years ago.8

In early March the outstanding copper contracts on the Shanghai Futures Exchange hit a record high, totalling over 500,000 as investors increased their appetite for the red metal.

Add in the fact that the US dollar is expected to weaken9 and copper’s attractiveness to global investors is only going to intensify.

Amidst this backdrop of soaring demand and tightening supply, emerges a key player, with the assets, the leadership, and the funding to make a huge splash…

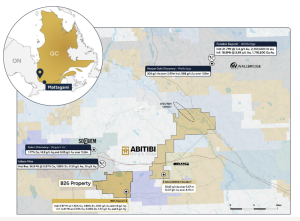

Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) is strategically positioning itself in the copper market, securing the funds to complete a 7-year option agreement in just four months to acquire an 80% stake in the B26 Polymetallic Copper Deposit — an advanced, high-grade exploration project in the heart of the Abitibi Greenstone Belt that was initially funded by the Quebec government. 10

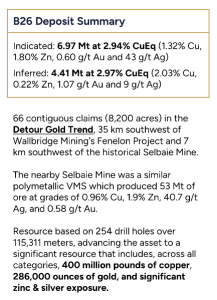

The B26 Deposit, a hidden gem until recently due to its private ownership, contains an impressive 400 million pounds of copper across both categories (Indicated and Inferred) and boasts an historical 2018 indicated resource of 6.97 million tonnes at 2.94% copper equivalent (Cu Eq) and 4.41 Mt at 2.97% Cu Eq inferred.11

The project has considerable room for expansion, which is why Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) is conducting a 50,000-metre drill program that’s fully funded and already well underway.12

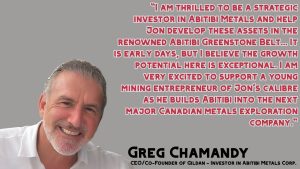

With the backing of heavyweight investors such as the Deluce Family, Greg Chamandy, and Frank Giustra, Abitibi Metals is distinguishing itself in the competitive copper landscape.

“The results highlight the exceptionally high grade of the deposit. With a well-capitalized treasury, strong leadership and one of the most promising copper and gold projects in North America, Abitibi is in an excellent position.” – Greg Chamandy 13

The company is composed of an all-star advisory board that held pivotal roles at Hecla Mining, Eldorado Gold, Agnico Eagle, Kirkland Lake Gold and Skeena Resources.

As the critical race for copper heats up, Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) is set to make significant strides in 2024 and beyond.

8 Key Reasons

Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) is Built for Success

1

Strategic Location in Quebec: Positioned in one of North America’s most mining-friendly jurisdictions, Abitibi Metals Corp. benefits from a rich history of copper production and a supportive regulatory environment.

2

Flagship B26 Deposit: Boasting a substantial historical 2018 resource including, 6.97 Mt at 2.94% Cu Eq indicated and 4.41 Mt at 2.97% Cu Eq inferred,14 the B26 Deposit offers significant expansion potential, especially with copper prices being much higher than they were in 2018 when the estimate was first calculated.

3

Market Potential for Copper: Amidst a global copper bull run driven by demand for electric vehicles and renewable energy, AMQ is poised to capitalize on the rising copper prices.

4

Fully-Funded Exploration: With a solid financial foundation, Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) is focusing on accelerated exploration in 2024 and beyond, enhancing the value of its projects.

5

Promising Beschefer Gold Project: In addition to copper, AMQ’s Beschefer Gold Project presents a golden opportunity with impressive drilling results and near-term resource potential.

6

Strong Backing and Leadership: Supported by the Deluce family and notable investors like Greg Chamandy and Frank Giustra, AMQ is led by a team with a proven track record in the mining industry.

7

Comparative Advantage: Relative to peers like Foran Mining and Agnico Eagle, AMQ’s B26 project stands out for its high-grade deposit and strategic positioning, in a mining-friendly jurisdiction and surrounded by crucial infrastructure for the project’s long-term future.

8

Robust Financial Health: With a healthy balance sheet including $19 million cash, no debt, and strategic investors, Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) is well-positioned for sustainable growth.

The Deluce Legacy: A Foundation of Success

When you hear the family name “Deluce,” think pioneers. This family doesn’t just join the game—they change it.

Known for revolutionizing the skies with Porter Airlines, this family’s knack for industry-shaping moves is legendary.

Now, they’re channeling this prowess into precious metals with Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF).

Here’s the scoop: The Deluce family has carved out a 25-year legacy in mining, distinguished by bold decisions and successful ventures. With Jon Deluce leading, they embody the essence of AMQ.

Their negotiation skills are top-notch, securing profitable partnerships effortlessly, and for their latest venture with AMQ, they’ve rallied support from industry giants like Frank Giustra15 and Greg Chamandy16.

So, what does this mean for you, the investor? It’s simple: aligning with the Deluce family is like choosing the winning team before the game even starts.

This Could Be Canada’s Next Mining Story: The B26 Project

In the heart of Quebec’s mineral-rich landscape, Abitibi Metals Corp.’s (CSE:AMQ) (OTCQB:AMQFF) flagship B26 project stands as a beacon of potential in the copper and precious metals arena.

Situated just 5 km south of the historic Selbaie mine, which produced 52 Mt (Metric Tonnes) over 20 years, the B26 asset is not just another deposit; it’s a game-changer in the making.

With a historical resource estimate boasting 6.97 Mt at 2.94% Cu Eq indicated and 4.41 Mt at 2.97% Cu Eq inferred,17 B26 contains an impressive 400 million pounds of copper, 286,000 ounces of gold and significant zinc, and silver exposure across both categories (Ind & Inf).

The B26 resource estimate was calculated in 2018 under SOQUEM (a private company with public funding from the Quebec government) when copper prices were lower, potentially impacting the cut-off grade used. Now, with higher copper and gold prices and Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) at the helm, a revised estimate could reveal a larger resource.

Additionally, now being part of a public company allows for better market visibility and valuation of B26.

Since acquiring the B26 on November 13, 2023, Abitibi Metals Corp.’s (CSE:AMQ) (OTCQB:AMQFF) shares have soared over 290%18.

As mentioned, this deposit is open for expansion both laterally and at depth, offering tantalizing prospects for future growth, including but not limited to a potential revaluation pending an upgrade involving open-pit possibilities.

Press Releases

- Abitibi Metals Extends High-Grade Central Lens In Infill Drilling At The B26 Polymetallic Deposit

- Abitibi Successfully Completes First Phase of 50,000 Metre Drill Program at the B26 Polymetallic Deposit; Assays from 34 Holes Pending

- Abitibi Metals Unveils 3D Geological Model For The High-Grade B26 Polymetallic Deposit

- Abitibi Metals Drills 97.5 Metres at 1.47% CU EQ Near Surface at the B26 Deposit

- Abitibi Metals Expands Maiden Drill Program to 13,500 Metres at the B26 Deposit

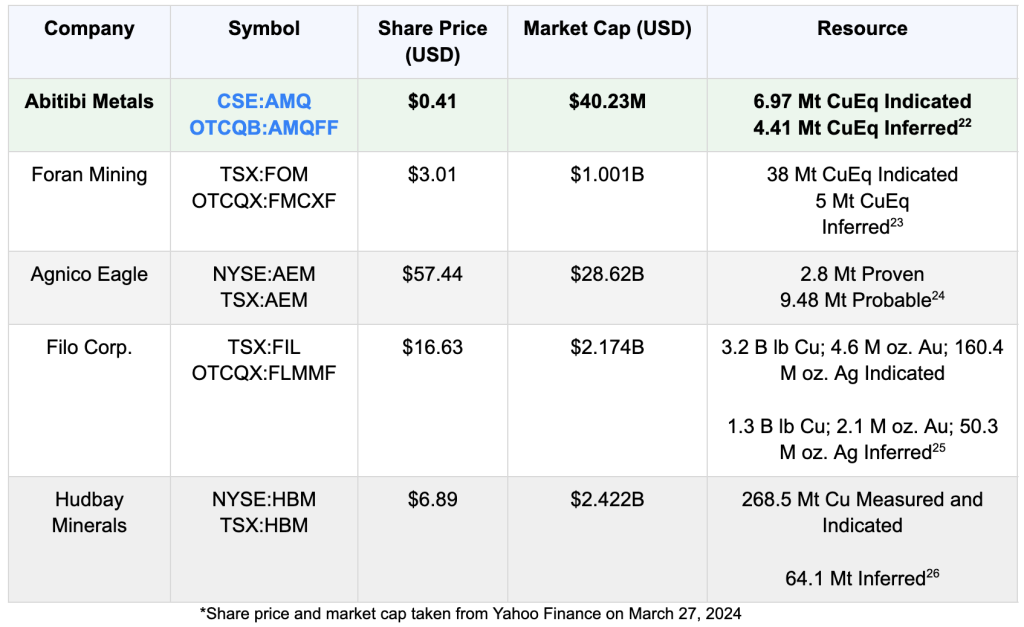

But how does B26 stack up against its peers? Let’s dive into the comparisons:

Foran Mining: The Closest Compelling Comparable

Foran Mining’s McIlvenna Bay project, often cited as the closest comparable to B26, is a carbon-neutral copper development in Saskatchewan, one of the world’s premier mining jurisdictions.

With Probable Mineral Reserves of 25.7 Mt at 2.51% CuEq, McIlvenna Bay is a significant and scalable resource.19 The project has demonstrated continuous high-grade mineralization, with recent assays outlining 44m at 2.9% CuEq20.

Moreover, Foran Mining recently announced a successful C$200 million private placement, underscoring the market’s confidence in its potential 21. As of March 27, 2024, Foran has a market cap of C$1.365 billion.

Agnico Eagle’s LaRonde Complex: A Benchmark in Quebec Mining

Agnico Eagle’s LaRonde Complex, another major player in the Quebec mining scene, provides a different perspective.

With a history dating back to 1988 and a deep 2.2-km shaft, LaRonde is a testament to the longevity and richness of Quebec’s mining industry. In 2022, the complex produced 356,337 ounces of gold, with proven and probable gold reserves of 3.2 million ounces. The LaRonde deposit is a gold-rich VMS deposit with significant silver, zinc and copper credits. The presence of silver and base metals adds considerably to the value of LaRonde’s gold ore, reducing the total cash cost to produce each ounce of gold on a by-product basis.

While it’s challenging to compare a major’s assets directly to AMQ’s B26, LaRonde’s success story highlights the potential of mining ventures in this region.

Table: Comparative Analysis of Key Mining Projects

B26: A Game-Changer for Abitibi Metals and the Copper Market

Abitibi Metals’ (CSE:AMQ) (OTCQB:AMQFF) B26 project is not just another asset; it’s a company that deserves your attention right now.

With a rich vein of copper and precious metals, room for further discoveries, and an advantageous geographical position, B26 is set to significantly influence the copper market.

The surge in copper demand, fueled by the transition to green energy, highlights the growing importance of ventures like B26.

Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) is moving quickly with an aggressive exploration strategy, featuring a 50,000-metre drilling program aimed at revealing the full value of the B26 deposit

For investors, keeping a close eye on B26 is not just an option; it’s a necessity.

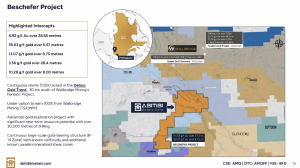

Abitibi’s Golden Opportunity: The Beschefer Gold Project

Just a leap away from the B26 deposit, the Beschefer Gold Project is Abitibi Metals’ (CSE:AMQ) (OTCQB:AMQFF) precious metals project in the prolific Abitibi Greenstone Belt.

With over 35,000 meters of drilling revealing standout intersections like 4.92 g/t Au over 28.65m, 55.63 g/t gold over 5.57m, and 13.07 g/t gold over 8.75m, Beschefer is a golden part of AMQ’s portfolio.

This advanced exploration project, located just 7 km from the B26 deposit and near the past-producing Selbaie Mine and Wallbridge Mining’s Fenelon Gold property, is set for further drilling of 2,000 to 4,000 meters.

With a significant near-term resource potential, and its potential role in a larger PEA assessment when grouped in with the B26 and a continuous large-scale gold-bearing structure, the Beschefer Gold Project is poised to become another shining star in Abitibi Metals’ (CSE:AMQ) (OTCQB:AMQFF) crown.

Backed by friendly option terms with Wallbridge and strong shareholder support, the future of Beschefer is as bright as the gold it harbors.

2024: A Year of Strategic Exploration and Growth

Abitibi Metals’ (CSE:AMQ) (OTCQB:AMQFF) ability to exceed its financial targets speaks volumes about its forward-thinking approach.

The company has upsized its private placement offering multiple times due to aggressive demand, which is now sitting at $7.1M, underlining its commitment to aggressive growth strategies.

This influx of funds equips AMQ to aggressively pursue its goals, notably to secure up to 80% ownership of the B26 Deposit and achieve its 7-year operational objectives remarkably within just two years.

With an allocated exploration budget of $10 million for the coming year, Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) is on the threshold of breakthrough developments.

The company aims to undertake an extensive 50,000-meter drilling campaign at the B26 Polymetallic Copper Deposit, focusing on both resource augmentation and the strategic expansion of its resource base.

In addition, the initiation of a 2,500-meter drilling endeavor at the Beschefer Gold Project underscores AMQ’s comprehensive exploration ethos, further diversifying its portfolio and potential for growth.

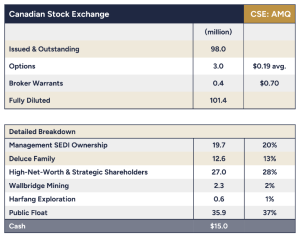

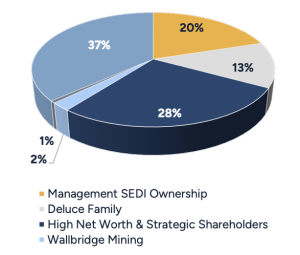

Solid Financial Foundation and Share Structure

Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) is financially rock-solid with $19 million in cash and a lean capital structure with a public float that consists of just 30.9 million shares.

The company’s shareholder composition is a testament to its stability and potential, with approximately 60% owned by strategic stakeholders, ensuring aligned interests and a focused drive towards value creation.

Abitibi Metals also stands out for its very limited warrant overhang, with only 700,000 warrants at $0.77, enhancing its capital structure’s attractiveness.

The management team alongside the Deluce family own about 30% of Abitibi Metals, highlighting their substantial investment in the company’s future.

This dedication is reinforced by strategic and affluent investors holding another 34%, indicating robust market trust in their vision.

Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) benefits from a well-distributed public float, positioning it for dynamic growth and significant impact in the mining sector.

The Driving Team Behind Abitibi Metals Success

Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) is led by a dynamic team with a track record of success in the mining industry:

RECAP: 8 Reasons

Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF) Is A Unique Leader in the Copper Boom

1

Quebec Advantage: Prime location in a top mining region with a rich copper history.

2

B26 Deposit: Significant resource with 6.97 Mt at 2.94% Cu Eq indicated and 4.41 Mt at 2.97% Cu Eq inferred,27 and room for expansion.

3

Copper Market Opportunity: Positioned to leverage surging market demand and the copper price boom, which just reached a 14-year high.

4

Exploration Ready: Fully-funded exploration plans set for 2024, promising further growth.

5

Gold Potential: The Beschefer Gold Project shows impressive near-term resource potential.

6

Strong Support: Backed by the Deluce family and renowned investors, with experienced leadership.

7

Peer Comparison: Stands out with a high-grade deposit compared to companies like Foran Mining and Agnico Eagle.

8

Financial Stability:$19 million in cash, zero debt, and the backing of strategic investors, setting the stage for continued growth.

With copper prices poised to witness a potential 75% increase by 2025, the market is ripe with opportunities.

Is it time to take a closer look at Abitibi Metals Corp. (CSE:AMQ) (OTCQB:AMQFF)?

Click here if you are seriously considering putting AMQ on your radar today.