Many people don’t realize it, but leaving your digital information unsecured won’t just harm you, it could put the entire world at risk.

Take North Korea, for instance. Did you know that HALF of their nuclear missile program is funded by cybercrime?1

In 2022, North Korean hackers stole a mind-blowing $1.7 billion, representing 44% of the $3.8 billion in digital currency stolen in 2022.2

Cybercriminals around the globe are getting more sophisticated, leading to more high-profile cybersecurity breaches.

Since the Colonial Pipeline ransomware attack in 2021, which cost the company $4.4 million,3 and was deemed the largest cyber attack on oil infrastructure in the US in history, a string of attacks have occurred including:

- Suncor Energy – cyberattack on Petro-Canada retail locations across the country wipes out debit and credit payments4

- Shell, Bombardier Aviation, Stanford University – among dozens of victims hit by the Cl0p ransomware gang5

- PharMerica – a ransomware gang stole 5.8 million patients’ data6

- T-Mobile – a 2023 data breach hit 836 subscribers before it was discovered7

- Western Digital – an ‘unauthorized third party’ gained access and stole personal info to the company’s online store customers8

- Kodi – 400k user records and private messages stolen9

The flurry of hacks has prompted regulators to tighten rules.The SEC now requires public companies to report material incidents within four business days.10 They also plan to require companies to disclose their cyber risk policies and procedures11 and many corporations are extremely unprepared.

Half of Fortune 100 companies have a director with cybersecurity expertise. Fortune 200 and 500 companies are much worse, with only 9% having cyber-savvy board members.

In short, it has become glaringly clear that these companies need to up their game or face dire consequences.

By 2025, we’re facing an estimated $10 trillion in cyber damage12 if we continue to take a “business as usual” approach to cybersecurity.13

Fortunately, we’ve uncovered a company that has cracked the code and is already keeping some of the most powerful organizations in the US safe from cybercrime.

With the unique AI capabilities of identifying malicious behavior within seconds, Plurilock Security Inc. (TSXV:PLUR) (OTC:PLCKF) is built to protect not only businesses, but also the digital assets and security of some of the world’s largest governments.

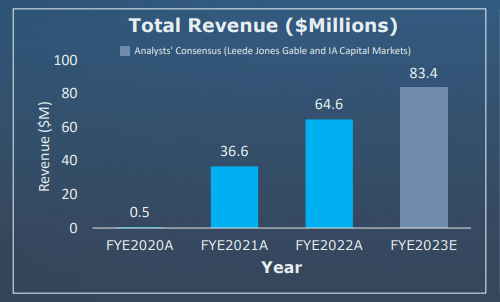

Plurilock Security Inc. (TSXV:PLUR) (OTC:PLCKF) has been public for approximately two years and has already grown its revenue by more than 100x from $479,000 in 2020 up to $64.6 million in 2022.

This year is also gearing up to be a big one for Plurilock Security after revealing a 127% increase in Q1 revenue to $15.8 million.14

With 6 game-changing patents under its belt and a growing base of more than 600 customers and partners ranging from large commercial enterprises to major public sector clients like NASA, the US Department of Defense, US Special Operations Command, the US Army, Navy, Marines and Airforce, Plurilock Security Inc. (TSXV:PLUR) (OTC:PLCKF) is capitalizing on a huge opportunity in cybersecurity.

According to Plurilock CEO Ian L. Paterson, public-facing attacks like the recent Suncor Energy incident could be “just the tip of the iceberg”15 which is why advanced AI-powered solutions like Plurlock’s are essential.

Now let’s take a deeper dive into why Plurilock Security (TSXV:PLUR) (OTC:PLCKF) is perfectly positioned to capitalize on cybersecurity’s rapid climb:

6 Reasons

to Add Plurilock Security Inc. (TSXV:PLUR) (OTC:PLCKF) to Your Watchlist

1

Strong Sales Growth of More Than 100x in Just 2 Years: Since going public in 2020, Plurilock continues to increase the sales of its high-margin proprietary products to increase gross margins: 2020 revenue of $479,000, 2021 FY revenue of $36.6M and 2022 FY revenue of $64.6M.

2

Tier 1 Customer Base of +600 Clients and Partners: Customers include top-tier organizations across various industry verticals, including the US Air Force, US Department of Defense, US Department of Navy, NASA, US Department of Homeland Security, and Canadian Department of National Defense.

3

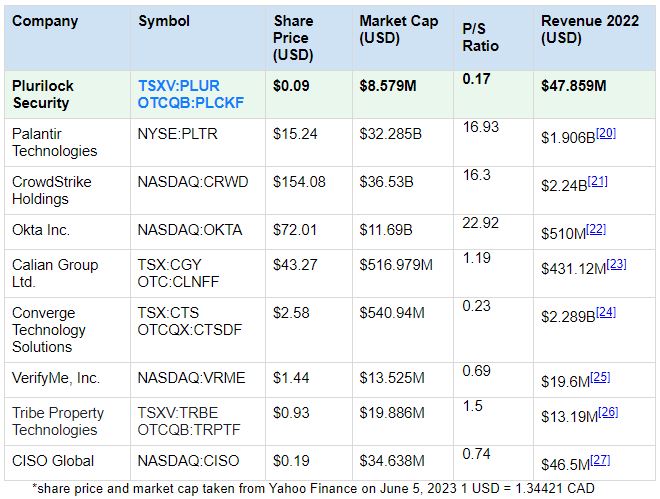

Blue Sky With Serious Upside Potential: Despite having significant revenue numbers and a lengthy list of high-profile clients, Plurilock Security Inc. (TSXV:PLUR) (OTC:PLCKF) has a market cap of less than $12 million and is trading at $0.13, revealing how undervalued this company truly is.

4

Highly Sought After Proprietary AI Technology: Plurilock’s (TSXV:PLUR) (OTC:PLCKF) Technology Division offers high-margin continuous authentication and cloud security solutions through its flagship platform, ‘Plurilock AI’, a cutting-edge continuous authentication solution that challenges the standard of the cybersecurity industry. Their patent portfolio consists of six issued and provisional patents.

5

Active M&A Program: Since 2021, Plurilock has rapidly grown its portfolio and client base, successfully completing four acquisitions including CloudCodes Software, Aurora Systems Consulting, Integra Networks Corporation, and Atrion Communications.

6

World-Class Leadership Team: Plurilock’s (TSXV:PLUR) (OTC:PLCKF) Management Team, Board of Directors, and Advisory Board consists of industry veterans who have held senior leadership roles at leading organizations such as Raytheon, the US National Security Agency, the US Navy, Forcepoint Federal, and IBM, and a proven track record of scaling financial technology companies.

Press Releases

- Plurilock Receives US$5.1 Million Sale Order From U.S. Department Of The Treasury

- Plurilock Receives US$4.2 Million Sale Order From U.S. Department Of Health And Human Services

- Plurilock Announces Contract With State Of South Carolina To Expand Distribution Statewide

- Plurilock Signs First Cross-Sale Order For PromptGuard With U.S. Financial Services Firm And Launches PromptGuard Version 1.0

- Plurilock Security Inc. Reports Record Second Quarter Fiscal 2023 Financial Results

Stacked Roster of High-Profile Tier 1 Customers and Partners

Over the course of building its reputation, Plurilock Security Inc. (TSXV:PLUR) (OTC:PLCKF) has built a roster of over 600 customers and top-tier partners.

To date, this includes US National Security and Defense Agencies such as NASA, US Air Force, US Navy, US Army, US Marine Corp, and Department of Defense (DOD).

As well, they’ve helped to secure the US Treasury US Department of Commerce, US Department of Justice, US Department of Agriculture, US Department of Transportation, US Department of Energy, US Department of Interior, US Department of State, US Department of Labor, Federal Trade Commission, US Department of Homeland Security and Office of Executive of the President.

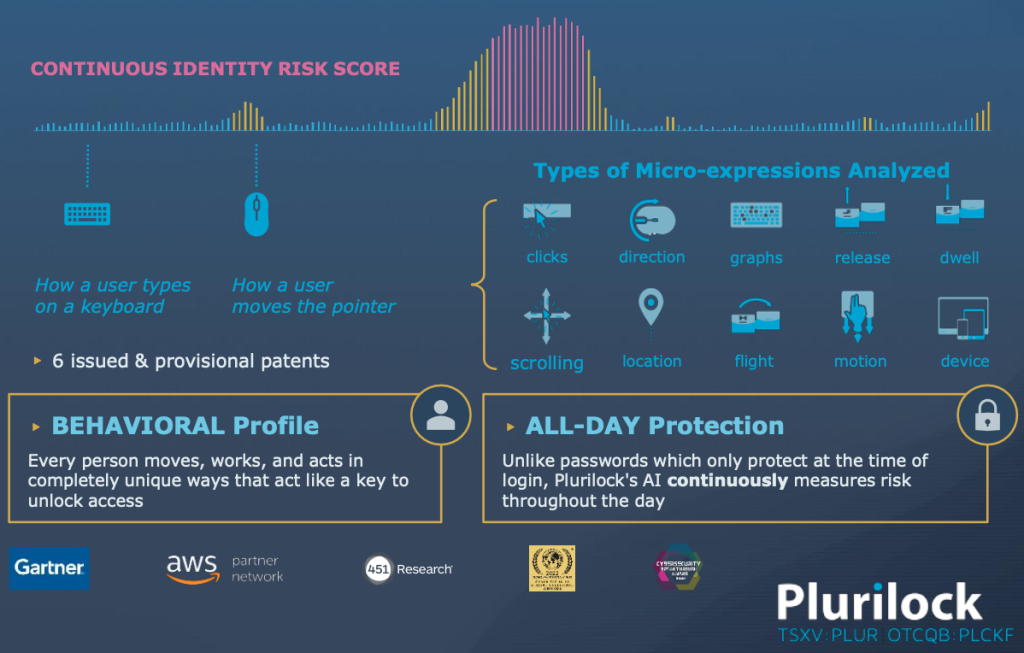

Plurilock leverages Behavioral Analytics and Artificial Intelligence (AI) to provide cutting-edge cybersecurity solutions. By analyzing individual behavior patterns, their AI technology can identify and detect malicious activities within seconds, offering real-time protection against cyber threats.

This has attracted a wide range of prominent clientele across both the commercial and public sectors in North America and in 5-Eyes allied countries.

The result has been a continuous momentum, bringing in some seriously huge purchase orders for Plurilock Security (TSXV:PLUR) (OTC:PLCKF) including $3.4M from Canada’s Department of National Defence,16 $1.4 million from the Canadian Federal Agency,17 and a total of $42.3 million in 2022.18

All of this has led to a meteoric rise in Plurilock’s (TSXV:PLUR) (OTC:PLCKF) revenue, increasing more than 100X since going public just two years ago. Now, analysts expect the company to reach $83.4M in 2023.19

Now Plurilock Security Inc. (TSXV:PLUR) (OTC:PLCKF) can officially boast a technology division that offers high margins from continuous authentication and cloud security solutions through its flagship platform, ‘Plurilock AI.’ This innovative AI-powered continuous authentication solution challenges the standard in the cybersecurity industry, providing superior protection for organizations and their sensitive data.

Yet, somehow the market seems to have missed the memo, as the valuation of Plurilock compared to its peers, especially when looking at its P/S Ratio, is baffling.

Patented High-Margin AI Software

Plurilock Security (TSXV:PLUR) (OTC:PLCKF) leverages its advanced AI technology to bring a new level of security to organizations by continuously measuring risk throughout the day—a stark contrast to traditional password-based systems that only provide protection during login.

One of Plurilock’s (TSXV:PLUR) (OTC:PLCKF) key offerings is their AI Cloud solution, a state-of-the-art product that boasts superior capabilities in terms of detecting anomalies, insider threats, and impersonation attempts.

Workers tend to use company platforms in their own unique way, which can be turned into a key to unlock access. Leveraging artificial intelligence, Plurilock’s (TSXV:PLUR) (OTC:PLCKF) CLOUD analyzes the behavior of users in real time, learning their habits and patterns, and thereby establishing a unique biometric profile for each individual. This ensures a high level of security, as it becomes incredibly difficult for an unauthorized person to mimic these unique behaviors.

It can be configured to send out alerts when it detects any suspicious activity, enabling companies to address potential threats promptly. This continuous, real-time monitoring and the capacity for rapid response offer a proactive approach to cybersecurity, significantly reducing the potential damage from security breaches.

This innovative approach to cybersecurity has led to Plurilock Security Inc. (TSXV:PLUR) (OTC:PLCKF) securing six issued and provisional patents.

One of those was for its multi-device identity confirmation technology. This patented system provides an added layer of security by confirming the identity of the user across multiple devices. It adds an extra layer of defense against potential security threats, making it even more challenging for unauthorized individuals to gain access.

Another provisional patent application is centered on insider threat protection technology that addresses one of the most significant cybersecurity challenges: threats coming from within the organization. This patented system identifies unusual behavior that might indicate an insider threat, effectively reducing the risk of damaging incidents caused by trusted insiders.

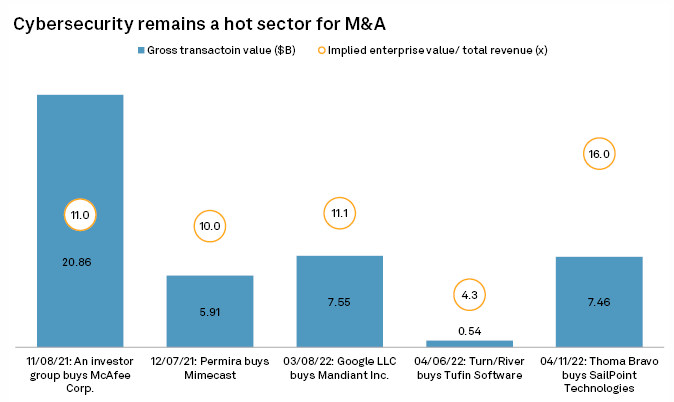

Cybersecurity Ripe with M&A/Cybersecurity Companies Being Taken Private

Taking the bird’s-eye view over the cybersecurity sector can be a bit overwhelming, as it’s still quite fragmented. However, there’s a trend emerging that’s showing signs of big consolidation, with acquirers, both financial and strategic, willing to pay a high premium for a business with plenty of expected growth—just like Plurilock Security Inc. (TSXV:PLUR) (OTC:PLCKF) has going on right now.

Private Equity firms are throwing out billions as they’ve gobbled up businesses over the last couple years, including:

- Thoma Bravo LP’s $6.9 billion acquisition of SailPoint Technologies Holdings Inc.28 and $1.8 billion acquisition of Magnet Forensics29

- Alphabet Inc. (Google) acquiring Mandiant for $5.4 billion30

- Absolute Software getting acquired by Crosspoint Capital for $657 million31

- Turn/River Capital acquired Tufin for $570 million32

A very interesting case study example is that of Absolute Software and its US$870 million Crosspoint Capital acquisition. First off, their buyers were the same ones that acquired pioneer cybersecurity giant McAfee Corp. in 2021 for US$14 billion.33

Prior to the deal’s announcement, Absolute, too, was doing the acquiring, adding Seattle’s NetMotion Software Inc. for US$340 million in 2021.34 Now they’ve unanimously approved a sale for US$870 million, in a move that takes them private.35

Here’s some food for thought: In FY 2022, Plurilock, which has a market cap of less than $12 million, generated $64.6 million in revenue or roughly one quarter that of Absolute’s FY 2022 revenue of $197.3 million—while the buying price of Absolute is more than 17x the current market cap of Plurilock. Really makes you think!

Strong Sales Growth (+100x)

When compared to its peers, Plurilock Security Inc. (TSXV:PLUR) (OTC:PLCKF) is elite, in terms of its P/S Ratio, and is due for some much-earned love from the market, based on its rapidly growing sales figures.

Prior to going public two years ago, Plurilock had an annual sales number of $479,000 but had ballooned those figures to $64.6M in 2022, and is on pace for $83.4M in 2023 after seeing Q1 2023 revenue increase by 127%.

That represents a stunning 15,200% increase in just three fiscal years.

World-Class Leadership Team

Leading the way for Plurilock Security Inc. (TSXV:PLUR) (OTC:PLCKF) is a stacked team consisting of industry veterans that have held roles at such prestigious enterprises as Raytheon, the US National Security Agency, the US Navy, Forcepoint Federal, and IBM, all while bringing a proven track record of scaling financial technology companies.

The Plurilock (TSXV:PLUR) (OTC:PLCKF) team includes:

RECAP: 6 Reasons

to Seriously Consider Plurilock Security Inc. (TSXV:PLUR) (OTC:PLCKF)

1

Rapid Sales Growth: Plurilock (TSXV:PLUR) (OTC:PLCKF) has achieved impressive sales growth since going public in 2020, increasing its revenue from $500,000 in FY 2020 up to $64.6 million in FY 2022.

2

Tier 1 Client Base: Plurilock has over 600 clients and partners, including renowned organizations like the US Air Force, US Department of Defense, US Department of Navy, NASA, US Department of Homeland Security, and Canadian Department of National Defense.

3

Highly Undervalued with Blue Sky Potential: Plurilock (TSXV:PLUR) (OTC:PLCKF), which has a market cap under $12M, generated $64.6M in revenue in FY 2022 compared to Absolute’s FY 2022 revenue of $265M, yet Absolute’s market cap is more than 17x that of Plurilock.

4

Highly Sought-After AI Technology: Plurilock‘s Technology Division offers cutting-edge continuous authentication and cloud security solutions through their flagship platform, ‘Plurilock AI’. They hold a patent portfolio of six issued and provisional patents.

5

Active M&A Program: Plurilock (TSXV:PLUR) (OTC:PLCKF) has rapidly expanded its portfolio and client base through strategic acquisitions since 2021, including CloudCodes Software, Aurora Systems Consulting, Integra Networks Corporation, and Atrion Communications.

6

World-Class Leadership: Plurilock‘s Management Team, Board of Directors, and Advisory Board comprise industry veterans with senior leadership experience at leading organizations such as Raytheon, the US National Security Agency, the US Navy, Forcepoint Federal, and IBM, with a proven track record of scaling financial technology companies.

With the ongoing serious threat of international cybercrimes for governments and corporations, we’re witnessing a surge in demand for security solutions like the proprietary platforms provided by Plurilock Security (TSXV:PLUR) (OTC:PLCKF).

Despite witnessing Plurilock grow its revenue by over 100x, and garnering the trust of some of the world’s most powerful security organizations, the market is still valuing the company far below its peers.

This can only last for so long, and it’s only a matter of time before the market wakes up, or a potential giant buyer could come along and take Plurilock private.

So, now is as good a time as any to take advantage of an early-mover situation, meaning you should begin your due diligence. Click here to monitor Plurilock Security’s (TSXV:PLUR) (OTC:PLCKF) news and milestones.

*All figures are in CAD unless otherwise stated. Exchange rate 1 USD = 1.34420 CAD